Digital factoring for your company

Try Péntech’s factoring services for reliable revenues!

Digital factoring

You don't have to wait 15-30 days, or even longer, while the payment period is coming to an end and your customers pay. With Péntech, you basically 'sell' your invoice, which gives you the possibility to convert your open invoices to cash.

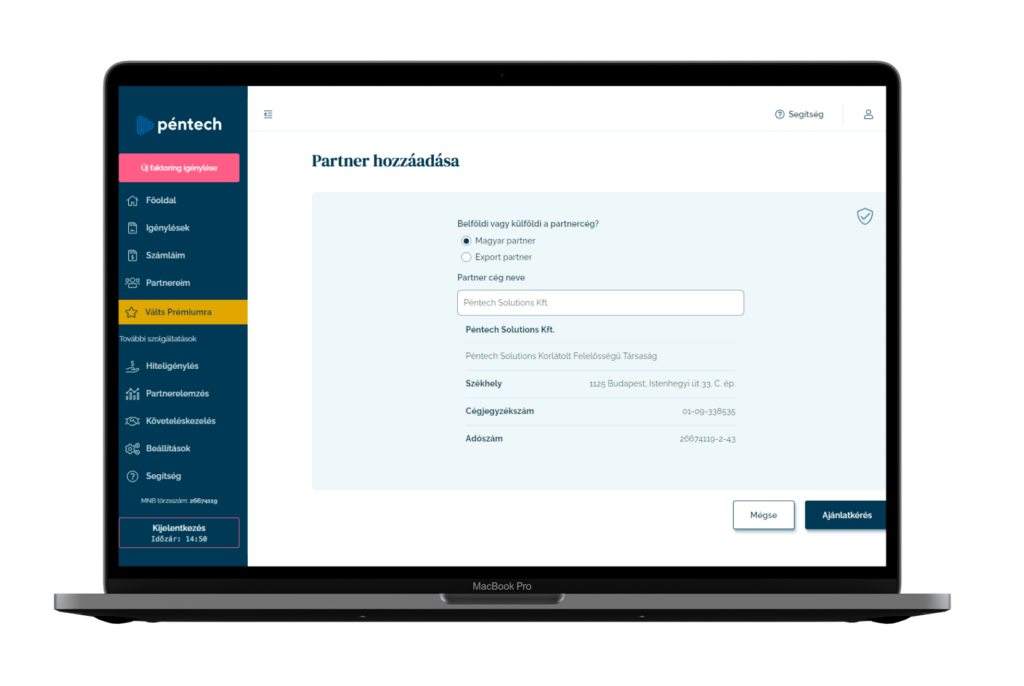

Completely online

administration

The funding process is simple, quick, and accessible online, therefore our customers can use Péntech anywhere and anytime they want.

Low, transparent

costs

We tailor our service to the needs of your company! Through our platform, you can factor from as few as one invoice and you'll always receive clear and concise information.

Without long-term

commitments

After registration, we provide free financial advice and you can request an offer from our colleagues. From signing the contract, you have the opportunity to decide when and how much you would like to factor.

How it works

Through the digital factoring platform of Péntech, You can upload the necessary documents with just a few clicks.

Register and upload your invoices

Registration is free and it takes only a couple of minutes. After a few fundamental questions, and a short authentication procedure, you can upload the documents of your company and the invoice(s) you'd like to factor.

1

2

Get an offer and funding budget

Using your information, the Péntech algorithms carry out a financial analysis. Based on these results, we provide you with a custom offer and a funding plan for your company.

Confirmation

As a next step, we make sure of the validity of the invoice and if necessary, we get in touch with your customer.

3

4

Contract and payment

If everything was correct and you accepted our offer, we sign the contract. After this step, the payment arrives at the account of your company which is usually 80-90% of the amount on the invoice with VAT.

Closing the procedure

Once the payment period comes to its end, your customer transfers the amount of the invoice to our financial partner. At this stage, we transfer the remaining 10-20% of the amount on the invoice with VAT to the account of your company.

5

Factoring calculator

Calculate how much factoring costs to your company with Péntech!

The Péntech calculator shows an approximate values and does not count as an offer.

To request an offer, register on our website with just a few clicks.

Get an offer today!

Are your invoices overdue?

We can help! Get to know Péntech's receivables management services.

Advantages of digital factoring

Competitive pricing

No hidden fees

Flexible contracts

High-level of discretion

Easy access

Lead time

Factoring

3-4 weeks

24 hours

Bank loan

4-5 weeks

Competitive pricing

No hidden fees

Flexible contracts

High-level of discretion

Easy access

Who do we recommend digital factoring for?

your customers are companies (B2B)

your customers pay with long deadlines (15+ days)

your company is in Hungary or has export claims

your invoice at least 1 million HUF to your partner on a monthly basis

your company aims to achieve a stable and consistent income

both for startups and large companies

Frequently Asked Questions

Hungarian SME-s face the challenge of maintaining their financial stability. One of

the reasons for this is their customers who pay after 30-60-90 days and late

payment is also common. Factoring provides a solution to this problem,

especially digital factoring. Factoring, similar to borrowing, is funded by a

financial institution, a bank, or a factor, who pays the money for the requesting

company.

With factoring, You will not have to wait weeks and months for the payment of

Your invoices. As part of the procedure, you basically “sell” your invoice to the

factor. You immediately receive the money, and Your client who owes Your

company this amount pays to the factor when the deadline is due. This way You

can shorten the payment period to 24 hours.

We will illustrate the process with a simple example:

Let’s take a person who delivers fruits and signs a contract with a hypermarket

chain to deliver his products. After the delivery, he has to wait for 30-45 or even 60

days while the payment period comes to an end and he receives the money in

exchange for his delivered fruits. This is the point when factoring comes into the

picture, as the person who delivers can decide to “sell” his invoice to a factor. This

way he will not have to wait until the due date of the payment, he can receive

approximately 90% of the amount of the invoice with VAT within 1-2 days from

the issue of the invoice. Altogether, factoring enables the person to deliver the

fruits to stabilize the financials in his company and even invest that money for

the company’s future growth.

Péntech operates as a tied agent – this means that we are acting on behalf of a financial partner, in the case of factoring, it is our subsidiary Péntech Financial Solutions Zrt., and in terms of borrowing, it is MKB Bank Nyrt. Our service offers a digital, unique solution in Hungary that makes the process of factoring quick and easy and helps companies to borrow. In the case of expired invoices, we offer our efficient help with claims management through our partners. Our supervisory authority is the Magyar Nemzeti Bank, they control our operation, and we are registered with them. Péntech won the most promising Hungarian fintech start-up award at the 2019 Fintech Show.

You need to upload the following documents:

- Invoice (open, has not expired)

- Delivery bill or certificate of completion

- Tax statement (not older than 30 days)

- The trial balance of Your company (not older than 3 months)

- Customer statement of account (customer analytics)

- Specimen signature

- Supply contract or order form

It can happen to anybody, we are flexible in terms of that. After the payment

deadline of the invoice, we do not charge You for late payment for the following

15 days – we look at it as if we agreed for 15 days more than our original plan.

After 15 days, we reach out to You to consult the following steps.

Nowadays, factoring is a widely-accepted, efficient solution and there is a high

chance that Your partner is familiar with it as well. Furthermore, it gives him the

signal that You, as his business partner, are able to pay, and he will not have to

worry about the delivery of future agreements. It is almost certain that You will

not be his first partner to factor and maybe he is already in touch with Péntech.

Sending in the bank account statement is optional, but helps us to be able to

give you a more accurate and precise offer. We request a summary for the last

90 days, where we can see each transaction itemised. It is downloadable from

most Hungarian bank’s NetBank site (for the fastest administration, please

download it in the format of “.csv”, “.xls”, “.xlsx”)